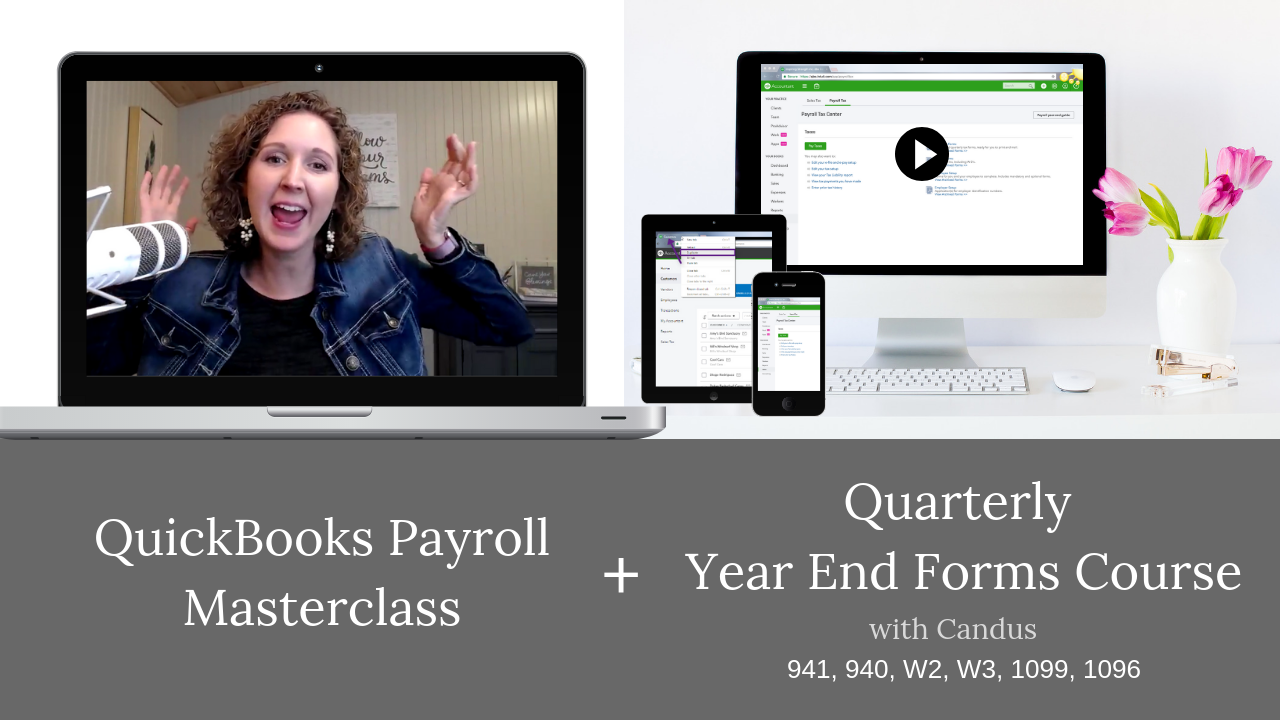

QuickBooks Payroll Masterclass

QuickBooks Payroll Masterclass

In this workshop Candus will cover:

Set up:

Setting up Payroll Items

Setting up Employees

Adding compensation types (hourly, salary, bonus, etc)

Adding PTO (sick & vacation time)

Setting up federal taxes (Income tax, FICA, etc)

Setting up the right taxes for your state

Reviewing your payroll set up

Creating payroll schedules

Understanding and adding payroll items

Running Payroll:

Entering employee time

Preparing employee paychecks

Printing & modifying paychecks

Printing employee paystubs

Running payroll reports

Exporting payroll data to Microsoft Excel

Special Transactions:

Running unscheduled & termination paychecks

Voiding paychecks

Mapping payroll items to get meaningful financial statements

**Bonus**

Quarterly & Year End Tax Form with Candus

Read The Overview

GET Instant Online Access

YES, please enroll me in the Quarterly & Year-End Tax Forms Course. I understand I will learn the following forms:

-- Quarterly Reports: 941, DE9, DE9C

-- Annual Report: 940/FUTA

-- W2's (Employees)

-- 1099-Misc and 1096 (Rent & Independent Contractors)

-- Bonus* How to pay your Payroll Taxes Manually and through E-Pay.

-- Course is about 54 minutes

See in the course!

~ Candus

Your information is safe and your order is secure.

You will receive an email confirmation upon successful registration.

IMPORTANT - By continuing with this purchase you verify that you have consented and agree with our terms of service and responsibilities at https://canduskampfer.com/Terms/